Quick Fire Dollar / Rand Update

28 October 2022

Dollar/Rand Weekly Candle

I remain of the opinion that, currently, this chart looks far more like a correction than a top.

The pullback level I had was as low as R17.60 before going higher has a minimum downside target of R17.87 that could have been reached yesterday.

I would seriously consider locking in Dollars (if you need to buy them) under R17.90 and buying into weakness. – there was a 2-hour period yesterday when the price traded sub R17.90.

The only way the market is not in a corrective phase based on the Weekly chart is if we close under R17.07. – this looks highly unlikely.

The good news is that the next leg higher would be well worth a top picker’s chance, as IMO this should be the last leg higher before starting a decent corrective phase.

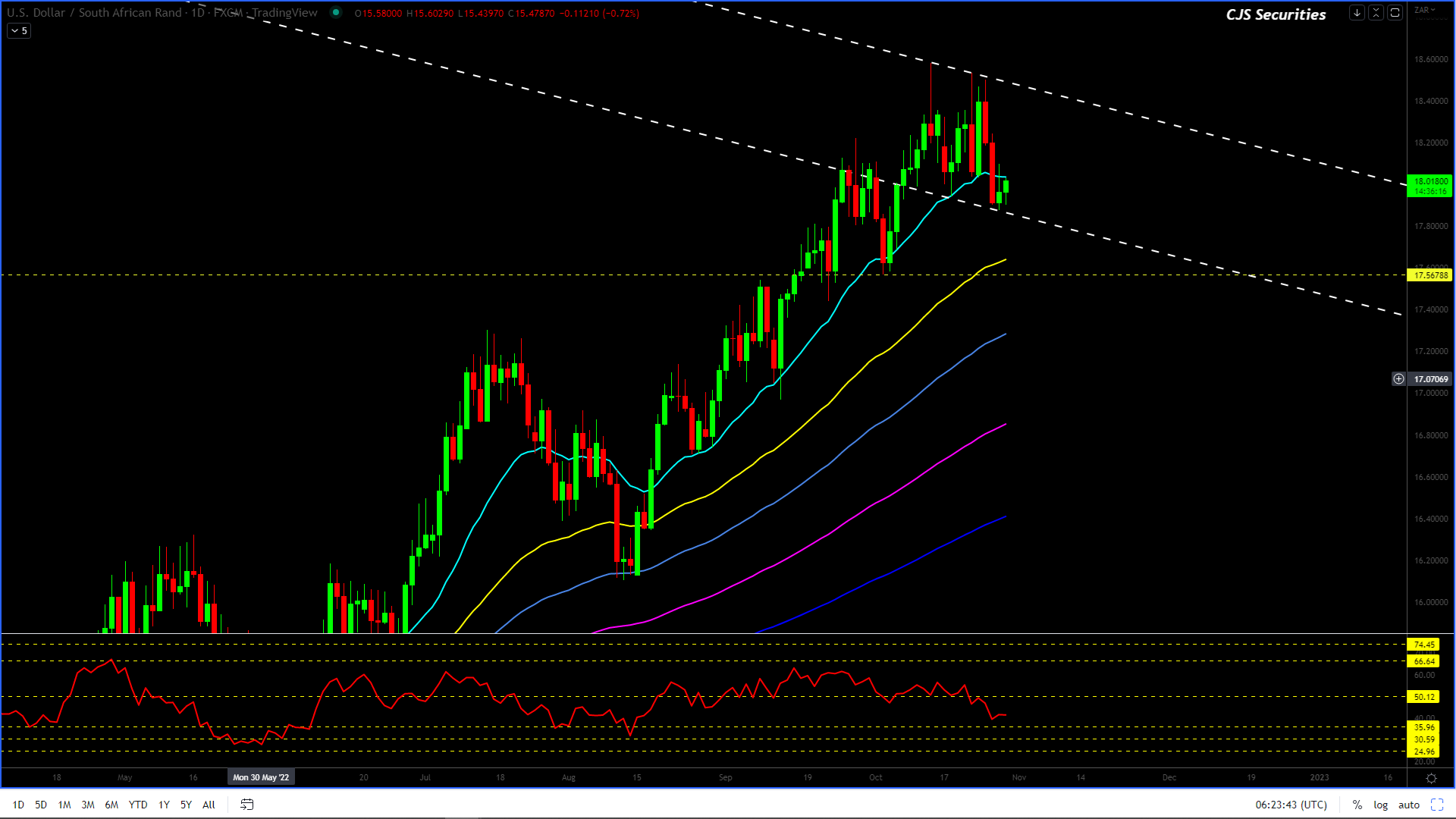

Dollar/Rand Daily Candle

The

Daily Chart starts to look more corrective than its Weekly counterpart.

The pullback

level on the Daily could potentially still trade as low as R17.60.

I would look to buy a dip of this nature as scale down

to R17.45 with

a stop under R17.40.

The Daily chart will only reverse

the upward trend based on a close under R17.17.

With the current price ranges

trading this wide, we would prefer to adopt a risk-off approach unless we see

the lower levels at which we can get long USD.

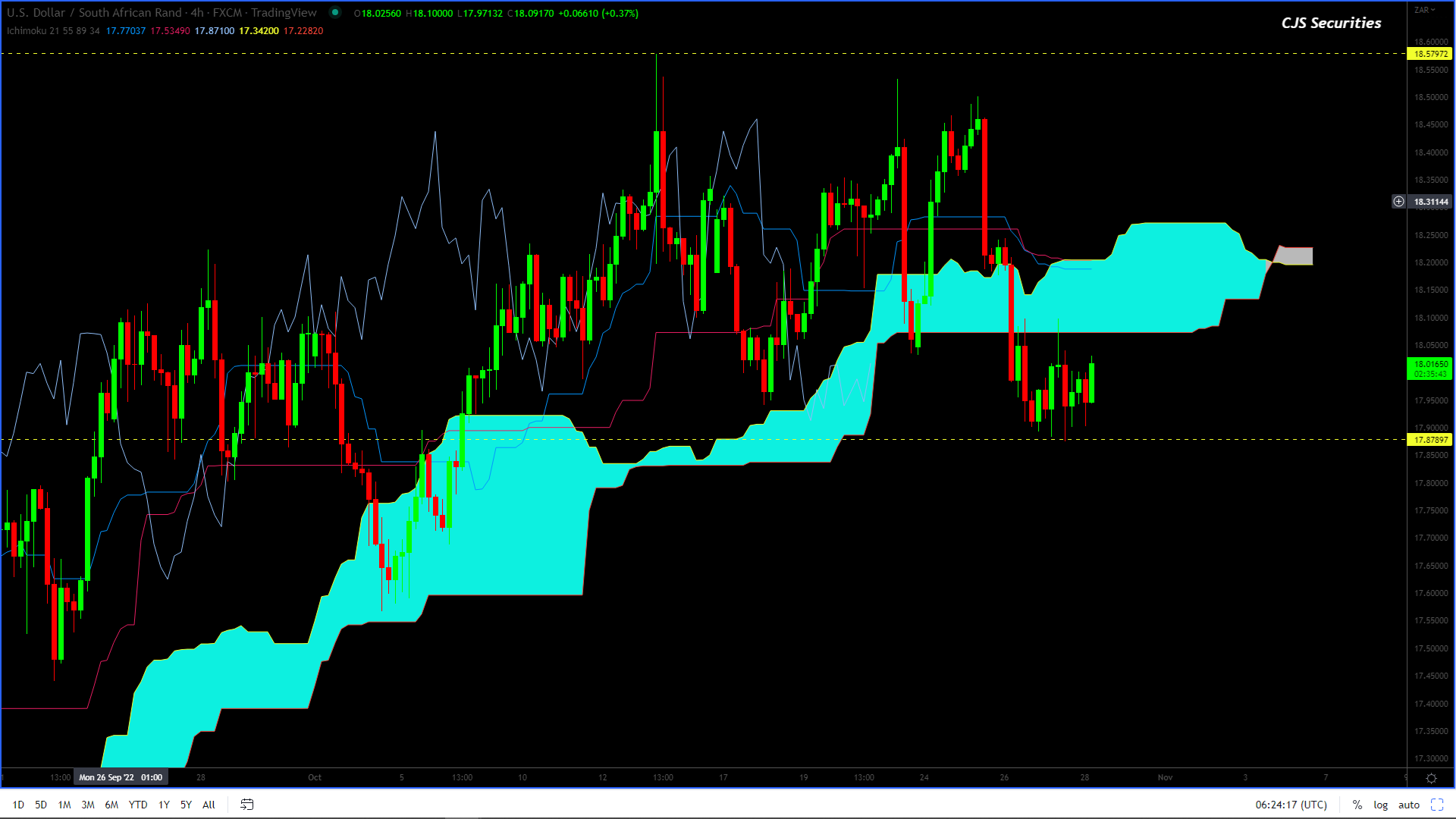

Dollar/Rand 240 Min Candle

The 240 Min Chart appears to be making a consolidation that will trade anything between R0.12 – R0.30 lower.

As mentioned, I feel we

are more in a corrective phase, and the chart’s current formation also lends itself

more to being corrective rather than a top formation.

Technically, I would look to

own the USD on a decent move lower with an SL under R17.55.

Because I feel this is a

correction, I would start buying Dollars under R17.90.